The Role of Security/Risk Assessment in Mergers and Acquisitions

Mergers and acquisitions (M&A) are significant business events that involve combining the operations, systems, and data of two entities. Amid the financial and operational components of M&A, security and risk assessments play a crucial role. These assessments are vital in identifying potential security risks and vulnerabilities that could impact the combined entity post-acquisition.

Importance of Security/Risk Assessment in M&A

In the context of M&A, security/risk assessments serve several key purposes:

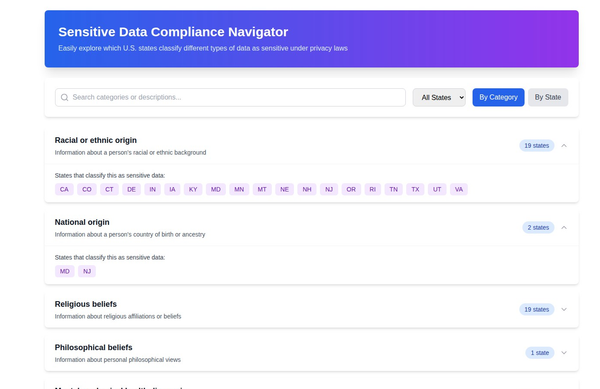

- Identifying Security Risks: The primary goal of a security/risk assessment in M&A is to identify potential security risks within each organization. This includes assessing the security of physical and digital assets, data privacy practices, and any potential vulnerabilities that could be exploited by cybercriminals.

- Informing Decision Making: The findings of the security/risk assessment can significantly impact the decision-making process in an M&A deal. For example, if significant security risks are identified, the acquiring company may choose to renegotiate the terms of the deal or, in some cases, abandon the acquisition.

- Planning for Integration: Post-acquisition, the combined entity will need to integrate their operations and systems. The security/risk assessment can inform this process by identifying potential security issues that need to be addressed during integration.

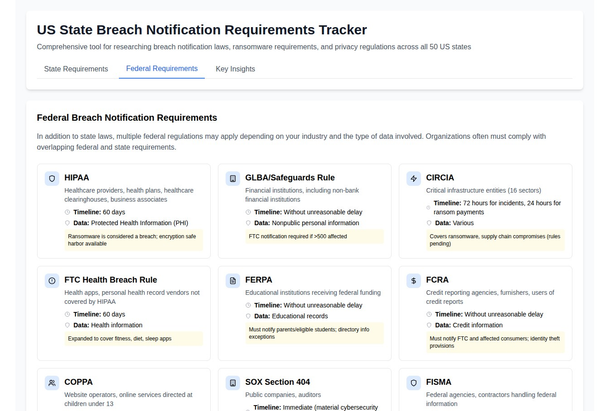

- Regulatory Compliance: In many industries, companies are required to conduct security/risk assessments to comply with regulatory standards. In the context of M&A, these assessments can help ensure that the combined entity will remain compliant.

Conducting a Security/Risk Assessment

Conducting a security/risk assessment during M&A involves several steps:

- Identify Assets: The first step in a security/risk assessment is to identify the assets of each company. This includes physical assets, digital assets, and data.

- Assess Vulnerabilities: Once assets have been identified, the next step is to assess any vulnerabilities. This includes examining the security measures currently in place and identifying any weaknesses or gaps.

- Evaluate Threats: After vulnerabilities have been identified, the next step is to evaluate potential threats. This includes considering both internal and external threats.

- Prioritize Risks: After threats have been identified, they must be prioritized based on their potential impact and the likelihood of occurrence.

- Develop a Mitigation Strategy: The final step is to develop a strategy to mitigate the identified risks. This includes implementing security measures to address vulnerabilities, developing incident response plans, and establishing ongoing monitoring and assessment processes.

Conclusion

Security/risk assessments are a critical component of M&A transactions. By identifying potential security risks and vulnerabilities, companies can make informed decisions, plan for integration, and ensure regulatory compliance. As such, security/risk assessments should be a priority during any M&A transaction.