Navigating the Complexities of Compliance in Digital Retail: A Comprehensive Guide

In today's rapidly evolving digital landscape, e-commerce businesses face a myriad of regulations designed to protect consumer data and ensure secure online transactions. Understanding and adhering to these compliance standards is not merely a legal obligation but a cornerstone of building customer trust, safeguarding brand reputation, and fostering sustainable growth. This document provides an in-depth overview of key compliance areas that digital retailers must navigate, drawing upon the Payment Card Industry Data Security Standard (PCI DSS) and various data privacy laws.

I. The Payment Card Industry Data Security Standard (PCI DSS)

A. What is PCI DSS Compliance?

The Payment Card Industry Data Security Standards (PCI DSS) are a set of practices necessary to protect cardholder information and mitigate the chances of fraud. Any retailers who accept card payments must adhere to and maintain these practices. PCI DSS applies to every digital retail business that handles, stores, and transmits payment or personal information for a debit or credit card.

B. Why is PCI Compliance Important?

Security is the top-most priority in the digital retail business as it handles various types of online payments. Compliance is crucial for safeguarding brand reputation, customers, and revenue. Failure to comply can lead to hefty fines, lost business opportunities, and legal fees, and also increases the risk of data breaches and fraud.

C. Key PCI DSS Requirements:

While the sources mention 12 PCI DSS compliance requirements, they do not detail each one. However, they highlight the impact of these requirements on how retailers accept and process payments.

D. PCI DSS Compliance Challenges in Digital Retail:

Maintaining PCI DSS compliance in the dynamic digital environment presents several challenges:

- Ensuring Data Security in a Dynamic Environment: Retailers deal with huge amounts of transaction data distributed across multiple platforms, making security a common challenge in the evolving cyber threat environment. Robust security measures that can easily upscale as technologies and threats evolve are crucial.

- Integrating Multiple Payment Systems and Ensuring Third-Party Provider Compliance: E-commerce businesses often integrate various payment systems and must ensure the compliance of their third-party providers.

- Adapting to Regularly Updated PCI DSS Standards: The PCI DSS standards are regularly updated, requiring ongoing adaptation. PCI DSS 4.0, the latest version, introduces new and enhanced requirements focusing on areas like customer browser security and robust data handling procedures to address modern cybersecurity challenges like online skimming and Magecart attacks. These new requirements are set to take effect by April 2025.

- Balancing Stringent Security with a Seamless User Experience: Retailers need to balance strong security measures with providing a smooth and convenient user experience for customers.

- Resource Constraints: Especially for small and medium retailers, managing PCI DSS compliance can be challenging due to limited resources.

- Staff Training on Security Requirements: Ensuring that staff are adequately trained on security requirements is essential for maintaining compliance.

- Managing the Compliance of Third-Party Vendors: Businesses depend on various third-party service providers and must check their compliance policies and sign strict Data Processing Agreements (DPAs) with them. Regularly auditing external vendors for compliance is also necessary.

E. Best Practices for Maintaining PCI DSS Compliance:

- Regular Security Updates: Deploying effective strategies like regular security updates is crucial.

- Comprehensive Employee Training: Providing thorough employee training on security best practices is essential.

- Incident Response Planning: Having a well-defined incident response plan is vital for addressing security breaches effectively.

- Using Trusted eCommerce Platforms: Opt for e-commerce platforms with robust security features that fulfill PCI DSS compliance requirements. These platforms often come with built-in security measures and updates, lessening the burden of maintaining compliance to a certain level.

- Preparing for Audits and Assessments: Conduct regular internal and external audits to continually ensure PCI DSS compliances are met. Partnering with professional auditors can help maintain documentation and provide a concise view of all compliance-related controls and processes. Large retailers with more than six million transactions per year would likely partner with a Qualified Security Assessor (QSA) to assess their compliance. Smaller retailers may assess their compliance internally. A Report on Compliance (RoC) validates adherence to PCI DSS standards and includes a detailed assessment by a QSA.

- Proactive PCI DSS 4.0 Compliance Planning: Early preparation for PCI DSS 4.0 is essential to understand and implement the 51 new requirements by the April 2025 deadline. This includes developing a comprehensive strategy with policy planning, execution, and necessary technical and cultural shifts. A phased implementation can help manage the compliance journey effectively.

- Implementing Robust Customer Browser Security Measures: PCI DSS 4.0 emphasizes safeguarding customer interactions through enhanced browser security to protect against online skimming and Magecart attacks. Best practices for payment page script security include implementing Content Security Policy (CSP) to specify allowed scripts and employing continuous monitoring for unauthorized modifications.

- Understanding Shared Responsibilities: In e-commerce implementations, PCI DSS responsibilities can be shared between the merchant and service providers. It is crucial to have written agreements that clearly document each party's responsibilities for implementing PCI DSS controls. Merchants are ultimately responsible for ensuring that service providers protect cardholder data.

- Knowing the Location of All Cardholder Data: Data-flow diagrams can help understand the scope of the cardholder data environment and identify all potential CHD "touch points".

- Minimizing Data Storage: If you don't need it, don't store cardholder data.

- Evaluating Risks Associated with eCommerce Technology: Thoroughly understand and document the unique characteristics of your e-commerce implementation, including interactions with payment transaction processes and cardholder data.

- Addressing Risks Associated with Outsourcing: When evaluating third-party services, request descriptions of security services and review their Attestations of Compliance (AOC).

- Regularly Reviewing Links to Payment Gateways: Confirm that URLs, iFrames, APIs, etc., linking to payment gateways have not been altered to redirect to unauthorized locations.

- Implementing Secure Coding Practices: A secure coding practice can eliminate many risks at the initial stages of application development.

II. Data Privacy Law Compliance

E-commerce operations are significantly influenced by data privacy laws such as GDPR, CCPA, and DPDP, which mandate specific security and privacy practices and impose obligations for data handling.

A. Impact on E-commerce Operations:

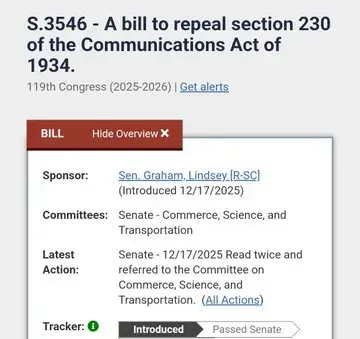

These laws curb how much data e-commerce businesses can collect, how and how long they can store it, and how it’s used and shared, impacting marketing efforts. Businesses must stay updated on regulatory changes to avoid hefty fines, lawsuits, and reputational damage.

B. Key Requirements of Data Privacy Laws:

- Obtaining Explicit Customer Consent: Businesses must explicitly ask for customer consent before collecting data, including for activities like subscribing buyers to marketing emails. There should be no pre-selected options in data privacy choices.

- Allowing Customers to Exercise Data Rights: Customers have the right to request deletion and correction of their data. Companies must provide a "Do not sell my data" link on their website under CCPA. Users can also request a copy of their stored personal data.

- Implementing Robust Data Protection Policies: Formulating robust data protection policies is essential.

- Ensuring Data Security: Implementing robust data security measures like encryption and access controls is crucial for privacy compliance. Companies must ensure the data they collect is rigorously safeguarded from breaches, theft, and unauthorized access.

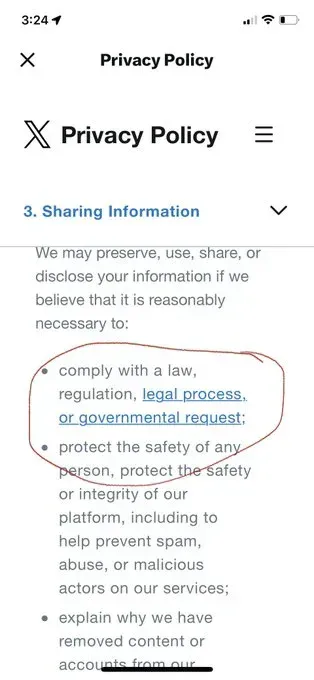

- Transparency in Data Collection and Usage: E-commerce businesses must shift towards customer data transparency, providing clear information about data collection and usage in clear privacy policies. Policies should detail what data is collected, why, and how it’s used.

- Purpose Limitation and Data Minimization: Data should only be collected for specified, explicit, and legitimate purposes and should be adequate, relevant, and limited to what is necessary.

- Accountability: Businesses are responsible for demonstrating compliance with data privacy laws through policies, procedures, and audits.

- Data Breach Notification: Data breaches must be reported within specific timeframes (e.g., 72 hours under GDPR).

- Compliance with Regional Laws: Companies operating in multiple regions must adhere to the regulations of all respective countries, including laws like the Connecticut Data Privacy Law and the E-Privacy Directive which regulates electronic communications, including rules on cookies and email marketing. India’s DPDP Act imposes fines for data privacy violations and has stricter rules for handling children’s data, as well as requiring payment processors to store customer data locally.

- Handling Data Requests and Opt-Outs Efficiently: Responsiveness to user requests for data access, correction, deletion, or opt-out is crucial for demonstrating respect for consumer rights.

C. Compliance Challenges for Retail and E-commerce Brands:

- Data Governance Issues: Establishing a solid framework for how to collect, store, use, access, and share sensitive customer data is challenging. This includes implementing strategies like role-based data access authorizations and encrypting sensitive data.

- Third-Party Data Sharing Risks: Ensuring the compliance of third-party vendors like payment processors, logistics partners, and marketing platforms is a significant challenge. Strict Data Processing Agreements (DPAs) and regular audits are necessary.

- Balancing Compliance and Omnichannel Customer Experience: Complex consent mechanisms can frustrate customers and reduce conversion rates. Brands must invest in technologies to automate compliance and monitor data flows without hindering the customer experience.

- Increasing Operational Costs: Compliance with data privacy laws can increase operational costs due to the need for legal teams and technological solutions.

D. The Role of Data Security in Privacy Compliance:

Implementing robust data security measures is significant for compliance. This includes investing in a robust security infrastructure to safeguard data from breaches, theft, and unauthorized access. Revisiting and making data policies more privacy-centric is also crucial, including being cautious about where data is stored due to jurisdictional restrictions.

E. Leveraging Technology for Compliance:

- AI-Driven Compliance and Automation: Automated risk assessments, real-time monitoring, and automated data deletions can help reduce compliance risks.

- Privacy Management Platforms: Platforms are available to help businesses manage data protection programs, staff management, and vendor management to comply with privacy regulations. Integrated management systems can provide structured frameworks, risk management tools, policy control, and audit readiness for both PCI DSS and data privacy compliance.

F. Ethical Data Handling as a Strategic Imperative:

Modern consumers are increasingly privacy-conscious, making ethical data handling and transparency strategic imperatives. Prioritizing customers by being transparent, explicitly asking for consent, and giving them full control over their personal data helps build trust and retain customers.

III. The Cost of Non-Compliance

The consequences of non-compliance with both PCI DSS and data privacy laws can be severe:

- Hefty Fines and Penalties: Violations can lead to substantial financial penalties, such as fines up to €20 million or 4% of annual global turnover under GDPR, and up to INR 250 crores under India’s DPDP Act.

- Damaged Reputation and Loss of Customer Trust: Data breaches and privacy violations can severely damage a company's reputation and erode customer trust.

- Legal Repercussions: Non-adherence can result in costly litigations and lawsuits.

- Lost Business Opportunities: Failure to comply can lead to a loss of business and potential interruption of operations.

- Increased Insurance Premiums: Companies may face higher insurance costs following data breaches.

IV. Building a Compliance Framework

Creating a robust compliance framework involves several steps:

- Conducting a Thorough Data Audit: Understand what data is collected and how it’s stored.

- Implementing Strong Data Security Measures: Employ encryption and access control.

- Regularly Training Staff: Ensure all staff understand the importance of compliance and keep up-to-date with requirements.

- Maintaining Up-to-Date Privacy Policies: Craft clear and comprehensive privacy policies that detail data collection, usage, and user rights.

- Prioritizing User Transparency: Outline data collection practices clearly and ensure users can make informed decisions about their data.

- Effectively Managing User Consent: Implement clear opt-in/opt-out mechanisms and maintain records of consent.

- Efficiently Handling Data Requests: Respond promptly to requests for data access, correction, or deletion.

- Conducting Security Audits and Risk Assessments: Routinely assess systems for vulnerabilities and analyze potential threats to personal data.

- Embedding Data Protection Measures: Integrate privacy considerations into the design of new services and projects (privacy-by-design).

Conclusion

In the digital retail sector, compliance is not a static checklist but a dynamic and ongoing process. By understanding the requirements of PCI DSS and data privacy laws, implementing best practices, and leveraging technology effectively, e-commerce businesses can transform compliance from a burden into a competitive advantage. Prioritizing data security and user privacy is fundamental for building lasting customer relationships, protecting business integrity, and ensuring long-term success in the evolving digital marketplace. Partnering with experts and utilizing integrated compliance management systems can significantly aid in navigating this complex landscape.