Digital Banking's Verification Crisis: How Poor Customer Controls Create Cybersecurity Vulnerabilities

From Monzo's £21 million fine to industry-wide compliance failures, financial technology's rapid growth has exposed critical security gaps that criminals are eager to exploit

The digital banking revolution promised seamless financial services, instant account opening, and user-friendly interfaces that would democratize finance. But as the smoke clears from years of explosive growth, a troubling pattern has emerged: the same technologies that enabled rapid customer acquisition have also created exploitable vulnerabilities that regulators are now targeting with unprecedented enforcement actions.

The Monzo Wake-Up Call

In what has become a defining case study of how verification failures can compromise cybersecurity, the UK's Financial Conduct Authority (FCA) recently imposed a £21,091,300 fine on Monzo Bank Ltd for its inadequate anti-financial crime systems and controls between October 2018 and August 2020. This wasn't just another regulatory slap on the wrist—it was a stark warning about how poor customer verification can create entry points for sophisticated cybercriminals.

During Monzo's meteoric rise, when its customer base exploded roughly tenfold to 5.8 million users, the digital bank's verification systems were woefully inadequate. The bank allowed accounts to be opened with what regulators described as "obviously implausible information," including customers who successfully registered using addresses like Buckingham Palace, 10 Downing Street, and even Monzo's own corporate headquarters.

These weren't just administrative oversights—they represented fundamental cybersecurity vulnerabilities. When financial institutions fail to properly verify customer identities during onboarding, they essentially create ghost accounts that can be weaponized for money laundering, fraud, and identity theft. Each improperly verified account becomes a potential vehicle for criminal activity, putting both the institution and legitimate customers at risk.

A Global Pattern of Compliance Failures

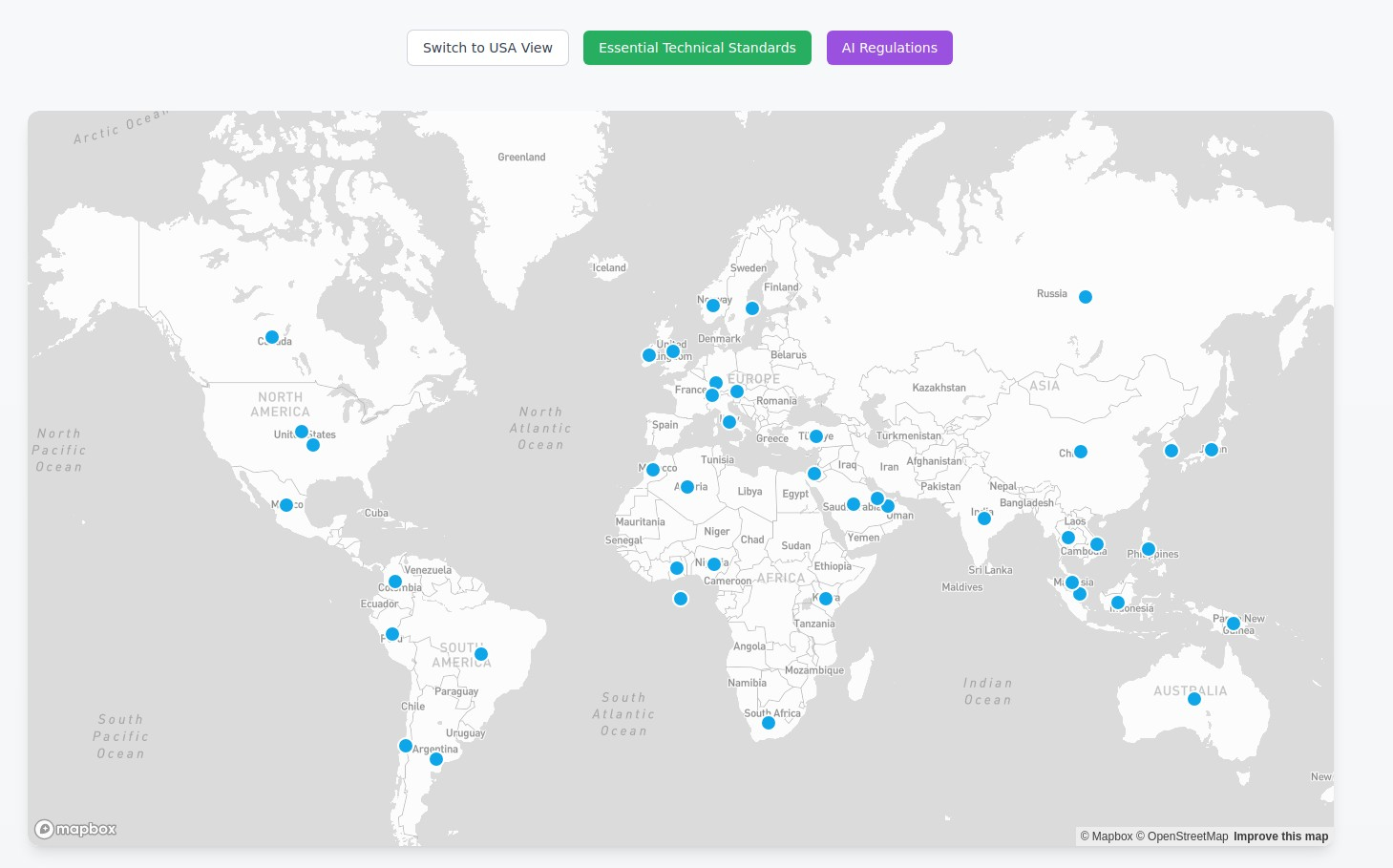

Monzo's predicament is far from unique. The financial services industry has been hit with a staggering wave of enforcement actions that reveal systemic problems in how institutions approach customer verification and anti-money laundering (AML) controls.

In 2023 alone, financial institutions worldwide were hit with $6.6 billion in fines for failing to combat money laundering—a dramatic 57% increase from the previous year. This escalation signals that regulators are treating these failures not merely as compliance issues, but as fundamental security breaches that enable broader criminal activity.

Consider some of the most significant recent cases:

Santander UK was fined £107.7 million by the FCA in 2023 for repeated failures in its AML controls, with regulators identifying serious weaknesses in the bank's procedures for monitoring and reporting suspicious activity.

TD Bank faced a record C$9.2 million fine from Canada's FINTRAC for AML non-compliance after a 2023 review found failures in monitoring high-risk accounts—deficiencies that attracted scrutiny from both Canadian and US regulators.

William Hill received a record £19.2 million fine from the UK Gambling Commission in March 2023 for social responsibility and AML failures, representing the largest penalty ever imposed by the commission.

These cases share a common thread: institutions that prioritized growth and user experience over robust verification and monitoring systems, creating vulnerabilities that criminals could exploit.

The Cybercrime Connection

While these enforcement actions often focus on regulatory compliance, the cybersecurity implications are profound. Poor customer verification creates what security experts call "attack vectors"—pathways that cybercriminals can exploit to infiltrate financial systems and commit fraud.

The connection became starkly apparent in recent cybersecurity incidents across the fintech sector. In November 2024, Finastra, one of the world's largest fintech companies, suffered a massive cyberattack where hackers obtained over 400GB of data, including sensitive client information. The breach highlighted how fintech companies, despite their technological sophistication, remain vulnerable to sophisticated attacks that can compromise customer data.

When verification systems fail, the consequences extend far beyond regulatory fines. Criminals can exploit these weaknesses to commit identity theft, financial fraud, or cause long-term credit damage to victims. The ripple effects can persist for years, as stolen personal information gets traded on dark web marketplaces and used in increasingly sophisticated fraud schemes.

The Human Cost of Security Failures

The abstract nature of regulatory fines can obscure the very real impact on consumers. When digital banks fail to properly verify customers, it creates an ecosystem where legitimate users become vulnerable to account takeovers, identity theft, and fraud.

Recent data breaches in the financial sector illustrate this vulnerability. In February 2024, Bank of America customers were affected by a data breach resulting from a cyberattack on Infosys McCamish Systems, a third-party data processor. The incident exposed sensitive customer information and demonstrated how verification failures can cascade through interconnected financial systems.

The stakes are particularly high in digital banking, where the entire customer relationship exists online. Unlike traditional banks with physical branches and in-person verification, digital banks rely entirely on technological controls to distinguish legitimate customers from fraudsters. When these controls fail, the consequences can be devastating.

Industry-Wide Vulnerabilities

The problems extend beyond individual institutions to reveal systemic issues in how the fintech industry approaches security. Digital banks like Monzo, Starling Bank, and Metro Bank have been identified as the UK lenders most impacted by online fraudsters who trick customers into sending payments to accounts outside their control—a vulnerability that poor verification systems can exacerbate.

The rapid growth model favored by many fintech companies creates inherent tensions between user experience and security. The pressure to onboard customers quickly can lead to shortcuts in verification processes, creating vulnerabilities that may not manifest until criminals begin exploiting them at scale.

Recent cybersecurity incidents have underscored these vulnerabilities:

- EquiLend, a leading New York-based fintech company, fell victim to a cyberattack in January 2024, though the full extent of the breach remains unclear.

- GrubHub suffered a data breach affecting customer, driver, and merchant data in early 2025.

- Multiple financial institutions have reported breaches affecting millions of customers, with stolen data including Social Security numbers, driver's license numbers, and dates of birth.

The Regulatory Response

Regulators worldwide are responding to these systemic failures with increasingly severe enforcement actions. The trend suggests that authorities are viewing inadequate verification not just as compliance failures, but as fundamental security vulnerabilities that enable broader cybercrime.

The FCA's approach to the Monzo case is particularly instructive. The regulator didn't just focus on the bank's failure to follow specific rules—it highlighted how these failures created opportunities for financial crime. This shift in regulatory perspective suggests that future enforcement actions will increasingly emphasize the cybersecurity implications of compliance failures.

The pattern of escalating fines—from tens of millions to hundreds of millions of dollars—indicates that regulators are prepared to impose penalties severe enough to force fundamental changes in how institutions approach customer verification and security.

Lessons for the Industry

The Monzo case and broader pattern of enforcement actions offer several critical lessons for the financial technology sector:

Security Cannot Be an Afterthought: The growth-at-all-costs mentality that characterized the early fintech boom is no longer sustainable. Institutions must build robust verification and monitoring systems from the ground up, not retrofit them after achieving scale.

Customer Experience Must Balance Security: While user-friendly onboarding processes are important for customer acquisition, they cannot come at the expense of basic security hygiene. The most sophisticated criminal networks are specifically targeting institutions with weak verification controls.

Third-Party Risk Management Is Critical: Many recent breaches have involved third-party processors and service providers, highlighting the need for comprehensive security assessments of entire technology ecosystems.

Regulatory Scrutiny Will Intensify: The dramatic increase in fines and enforcement actions suggests that regulators are taking a much more aggressive approach to financial crime prevention. Institutions that fail to adapt risk facing penalties that could threaten their survival.

The Path Forward

As the fintech industry matures, the companies that survive and thrive will be those that successfully balance innovation with security. This means investing in robust customer verification systems, implementing comprehensive monitoring controls, and building security considerations into every aspect of the customer experience.

The Monzo fine should serve as a wake-up call for the entire industry. In an interconnected financial ecosystem, the security failures of one institution can create vulnerabilities that criminals exploit across the entire sector. Poor verification practices don't just create compliance risks—they create cybersecurity vulnerabilities that put everyone at risk.

The digital banking revolution has democratized access to financial services and created tremendous value for consumers. But as the industry's rapid evolution continues, ensuring that growth comes with appropriate security measures isn't just a regulatory requirement—it's essential for maintaining the trust that makes digital finance possible.

The question now is whether the industry will learn from these costly lessons and build the robust security infrastructure necessary to support continued innovation, or whether more institutions will find themselves facing the kind of devastating enforcement actions that have already reshaped the competitive landscape.

For consumers, the message is clear: while digital banking offers unprecedented convenience, the security of these platforms depends on institutions taking verification and cybersecurity seriously. The multimillion-dollar fines being imposed on major financial institutions serve as stark reminders that in the digital age, security failures have consequences that extend far beyond regulatory penalties—they create vulnerabilities that criminals are all too eager to exploit.