Carbon Tracking in Financial Services: Compliance, Privacy, and Digital Identity Convergence

A Global Regulatory Analysis for Compliance Officers, CISOs, and Risk Management Professionals

Executive Summary

Financial institutions across the UK and Australia have implemented carbon footprint tracking systems that analyze customer transaction data to estimate environmental impact. While positioned as sustainability initiatives, these systems present significant compliance, privacy, and reputational risks that warrant immediate attention from compliance officers, data protection officers, and risk management professionals.

Key Findings:

- Regulatory Ambiguity: Carbon tracking systems operate in a grey area of data protection law, particularly regarding consent, purpose limitation, and data minimization principles under GDPR, UK GDPR, and Australian Privacy Act.

- Digital Identity Convergence Risk: The infrastructure for carbon tracking creates technical capability for integration with emerging mandatory digital identity systems in both jurisdictions, raising significant function creep concerns.

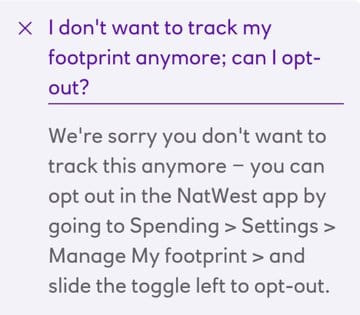

- Transparency Deficiencies: Multiple institutions lack clear documentation of opt-in/opt-out procedures, creating potential violations of transparency requirements under privacy regulations.

- Cross-Border Data Flows: Use of third-party providers (particularly Cogo, a New Zealand fintech) triggers complex cross-border data transfer requirements.

- Reputational Risk: Institutions implementing carbon tracking while simultaneously financing fossil fuel expansion face significant ESG credibility gaps and greenwashing allegations.

Bottom Line for Compliance Professionals: Financial institutions implementing or considering carbon tracking systems must conduct comprehensive privacy impact assessments, ensure explicit consent mechanisms, establish clear data governance frameworks, and prepare for potential integration pressures with digital identity infrastructure.

1. Overview: Carbon Tracking in Banking

1.1 Technology and Implementation

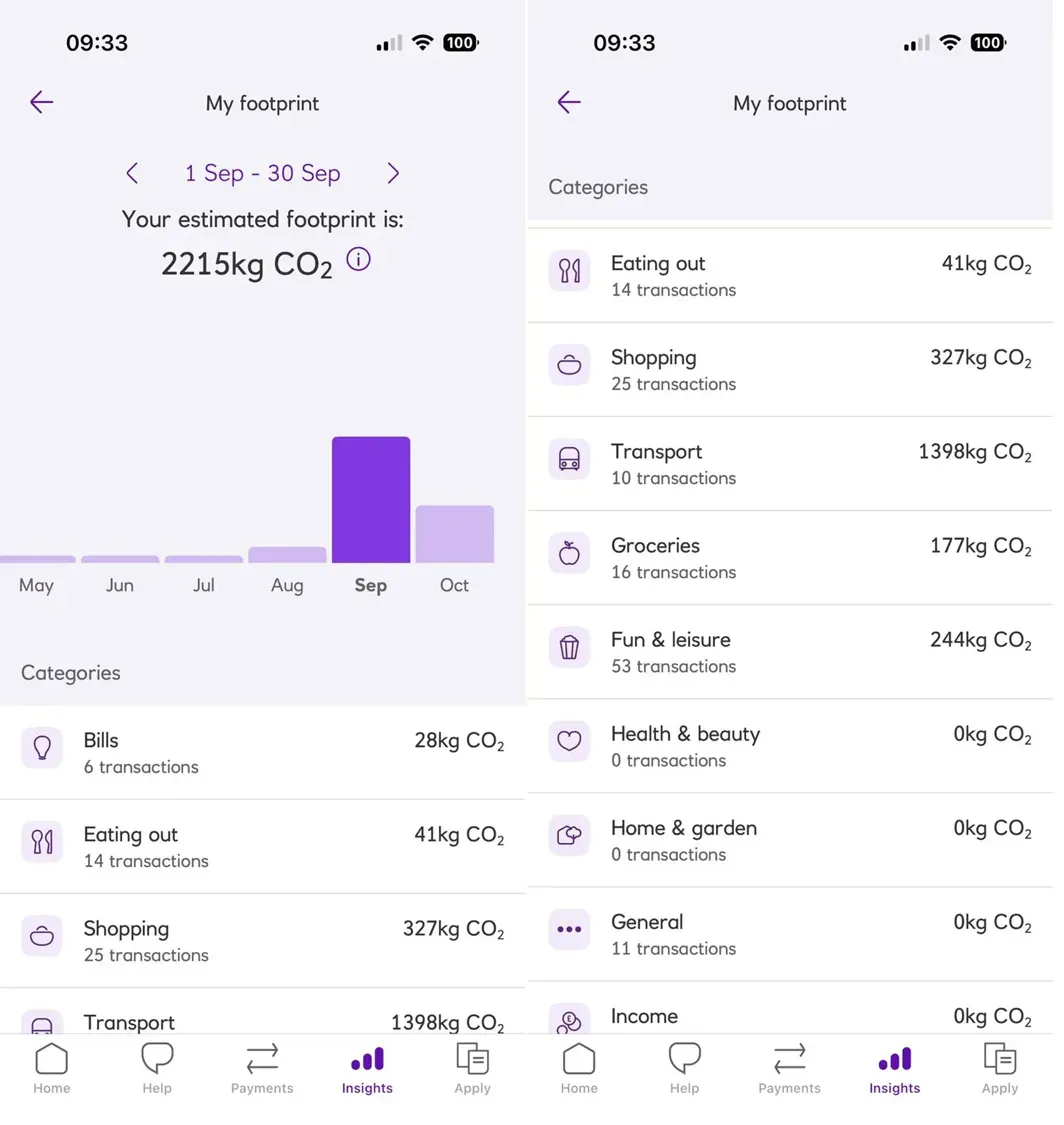

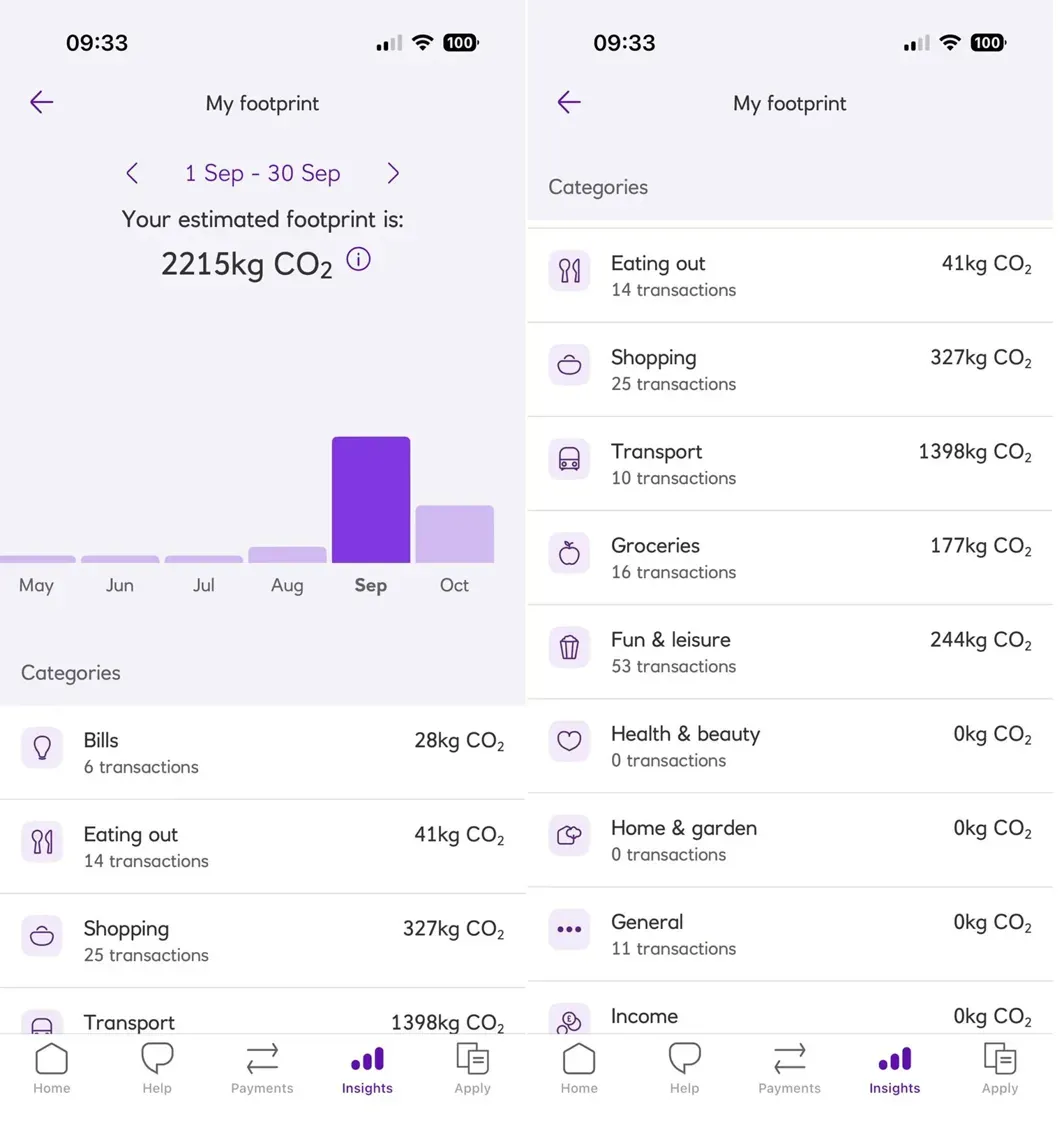

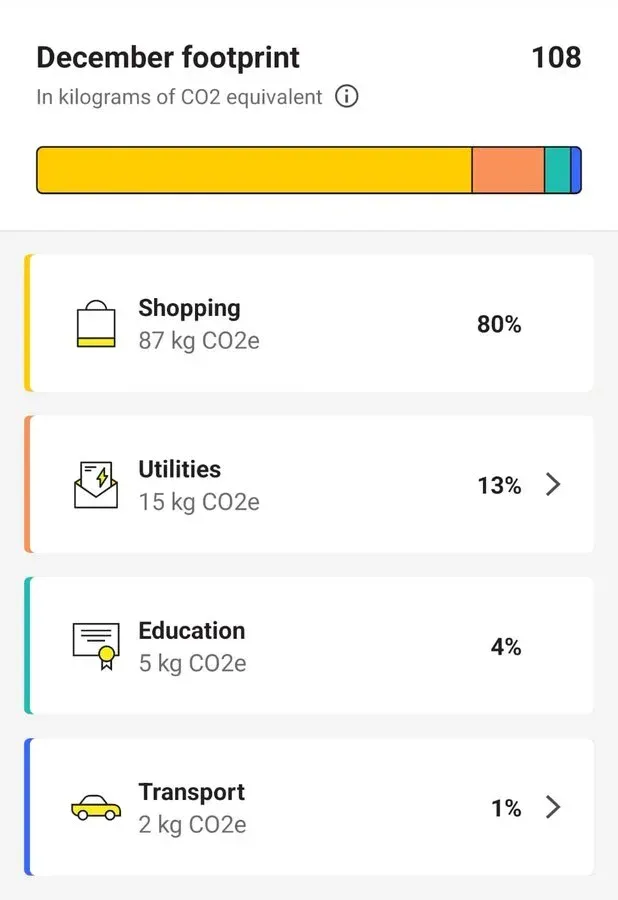

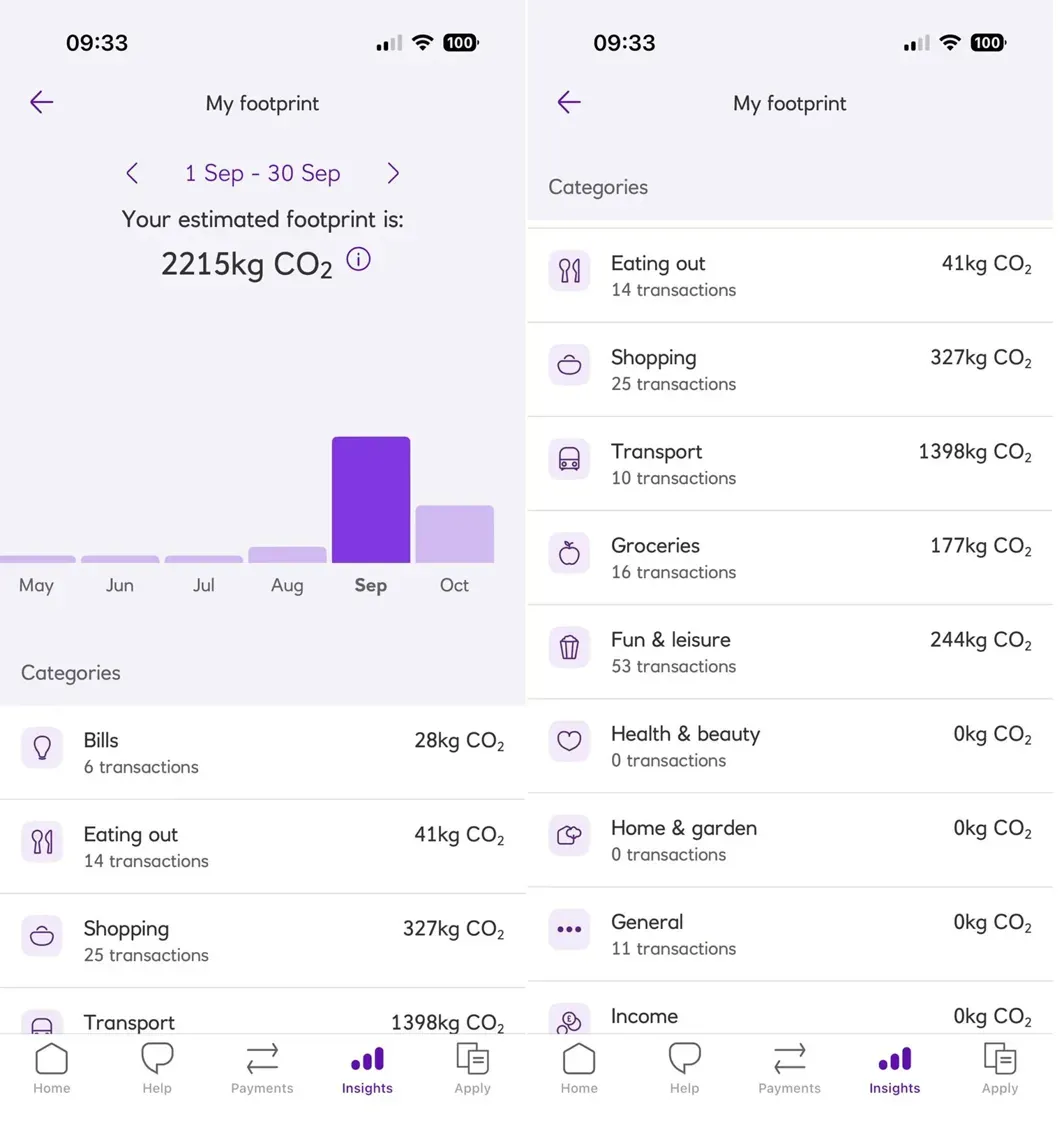

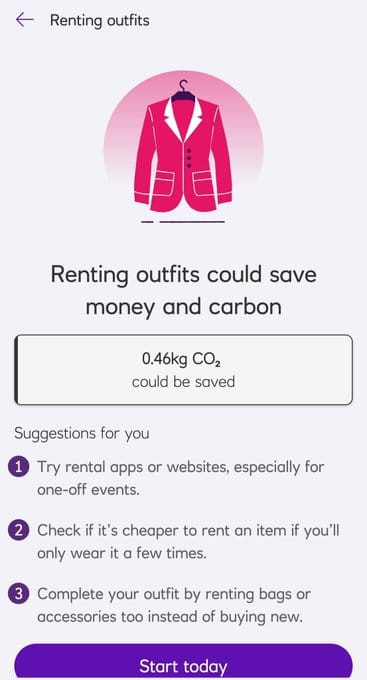

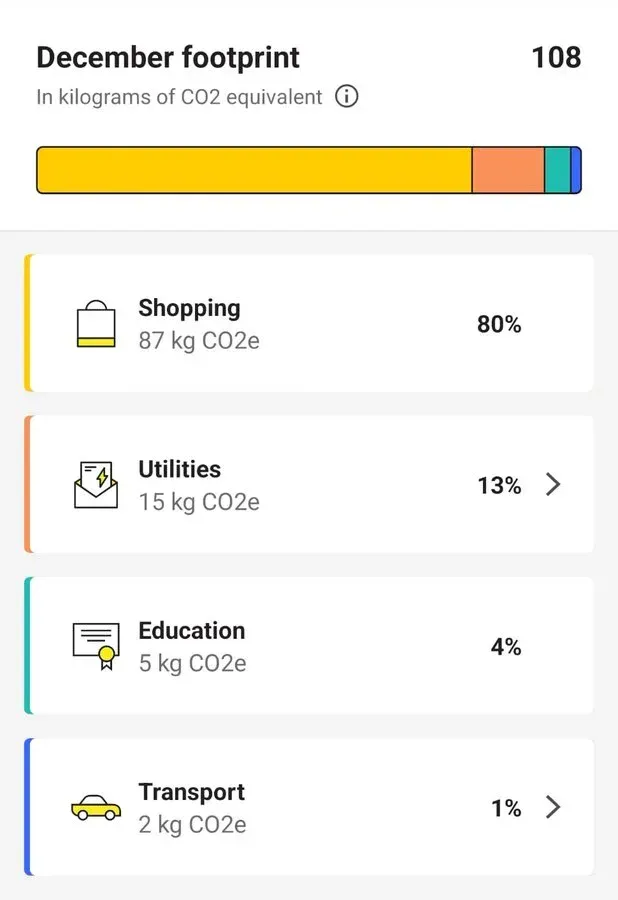

Carbon tracking systems in financial services analyze customer transaction data using emission factors provided by specialized fintechs (primarily Cogo) to estimate the carbon footprint associated with purchases. The technology works by:

Data Collection:

- Transaction merchant category codes (MCCs)

- Transaction amounts

- Merchant identification

- Payment instrument (credit card, debit card, BPAY)

- Geographic location of transactions

Processing Methodology:

- Categorization into industry sectors (transport, groceries, utilities, etc.)

- Application of emission factors (CO2e per currency unit spent)

- Aggregation into monthly carbon footprint estimates

- Comparison against national averages

Vendor Landscape:

- Primary Provider: Cogo (New Zealand-based fintech)

- Implementation Partners: Varies by institution

- Data Storage: Mixed models (on-premise, cloud, hybrid)

1.2 Market Adoption Timeline

| Date | Institution | Jurisdiction | Milestone |

|---|---|---|---|

| July 2020 | Westpac NZ | New Zealand | First implementation (pilot) |

| October 2021 | Commonwealth Bank | Australia | Pilot launch (250,000 customers) |

| November 2021 | NatWest | UK | Feature introduced |

| July 2022 | Commonwealth Bank | Australia | Full rollout to retail customers |

| May 2023 | Westpac | Australia | Full launch |

| 2022-Present | Multiple institutions | Global | Evaluation and pilot phases |

1.3 Stated Business Objectives

Financial institutions cite the following justifications:

- Customer Demand: Survey data indicating consumer interest in sustainability

- ESG Leadership: Positioning as environmental stewards

- Competitive Differentiation: First-mover advantage in sustainability features

- Regulatory Anticipation: Preparation for potential climate disclosure requirements

- Brand Enhancement: Marketing value of sustainability initiatives

Critical Compliance Question: Do these stated objectives satisfy the "necessary and proportionate" test under data protection law?

2. Jurisdictional Analysis: UK

2.1 NatWest Implementation: Compliance Profile

Launch Date: November 2021

Current Status: Active (as of October 2025)

User Base: Approximately 300,000 active users (~3.75% of 8 million app users)

Opt-In Requirement: Yes (explicitly stated)

Regulatory Context:

- Data Protection Regime: UK GDPR + Data Protection Act 2018

- Financial Regulation: FCA oversight

- Consumer Protection: Consumer Rights Act 2015

- Government Ownership: 38.6% taxpayer-owned (post-2008 bailout)

2.2 UK GDPR Compliance Analysis

Lawful Basis Assessment:

| GDPR Article | Potential Basis | Compliance Risk | Assessment |

|---|---|---|---|

| Art. 6(1)(a) | Consent | Moderate | Requires explicit, informed, freely given consent. NatWest claims opt-in, but quality of consent mechanism unclear |

| Art. 6(1)(b) | Contract Performance | High | Carbon tracking not necessary for core banking services |

| Art. 6(1)(c) | Legal Obligation | N/A | No legal requirement for carbon tracking |

| Art. 6(1)(f) | Legitimate Interest | High | DPIA required; difficult to demonstrate overriding legitimate interest vs. customer privacy |

Critical Compliance Gaps:

- Purpose Limitation (Art. 5(1)(b)): Transaction data originally collected for payment processing is being repurposed for environmental impact calculation. This requires either:

- Clear disclosure at collection, OR

- Compatibility assessment demonstrating new purpose is compatible with original

- Data Minimization (Art. 5(1)(c)): Questionable whether analyzing all transactions is necessary. Could carbon footprint be estimated from sampling?

- Transparency (Art. 13-14): Public-facing documentation lacks detail on:

- Exact data points used

- Retention periods

- Third-party access (Cogo)

- Data transfer mechanisms

DPO Considerations:

- Has a Data Protection Impact Assessment (DPIA) been conducted?

- Have affected data subjects been informed of new processing purpose?

- Is consent mechanism compliant with Art. 7 requirements?

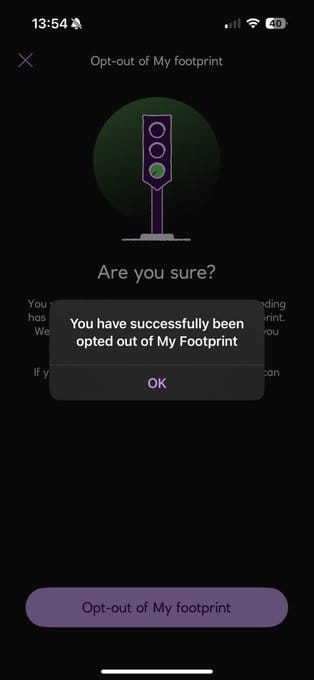

- Can consent be withdrawn easily and completely?

2.3 UK Digital Identity Context

The UK government announced in September 2025 mandatory digital identity ("Brit Card") for all working-age adults by end of this Parliament. Key compliance implications:

Mandatory Requirements:

- Required for Right to Work checks

- Stored on GOV.UK Wallet

- Contains: name, DOB, nationality/residency status, photo

- Central database verification

Integration Risk for Financial Services:

- Government has 38.6% stake in NatWest

- Potential pressure for data sharing arrangements

- No current legal framework preventing future integration

- Precedent: Know Your Customer (KYC) data already shared with government

For detailed analysis: UK's Mandatory "Brit Card" Digital ID: Privacy and Civil Liberty Concerns

2.4 UK Regulatory Enforcement Risk

ICO Enforcement Pattern (2023-2025):

- Increased focus on purpose limitation violations

- Significant fines for lack of valid consent mechanisms

- Growing scrutiny of "legitimate interest" claims for non-essential processing

Potential Triggers for ICO Investigation:

- Data subject complaints about lack of transparency

- Difficulty in withdrawing consent/opting out

- Discovery of undisclosed third-party data sharing

- Integration with government digital identity systems without clear legal basis

Risk Rating: Medium-High (if consent mechanisms are deficient or transparency inadequate)

3. Jurisdictional Analysis: Australia

3.1 Commonwealth Bank Implementation: Compliance Profile

Launch Date: October 2021 (pilot), August 2022 (full rollout)

Current Status: Active (visibility potentially reduced in recent app updates)

User Base: Unknown (reported ~300,000 in pilot; unclear if all customers now enrolled)

Opt-In Requirement: UNCLEAR (critical compliance red flag)

Key Compliance Concern: Multiple sources from 2022 suggest customers were "automatically opting in" to the feature. If true, this represents significant privacy law violations.

Regulatory Context:

- Data Protection Regime: Privacy Act 1988 (Commonwealth) + Australian Privacy Principles (APPs)

- Financial Regulation: APRA prudential standards, ASIC oversight

- Consumer Protection: Australian Consumer Law

- Recent Changes: Digital ID Act 2024 (commenced December 1, 2024)

3.2 Australian Privacy Principles (APPs) Compliance Analysis

Critical APP Assessment:

| APP | Requirement | Compliance Risk | Assessment |

|---|---|---|---|

| APP 1 | Open and transparent management of PI | High | Lack of clear public documentation on opt-in/opt-out procedures |

| APP 3 | Collection of solicited PI | Critical | If automatic enrollment occurred, collection may not meet "solicited" definition |

| APP 5 | Notification of collection | High | Unclear if customers were adequately informed before collection began |

| APP 6 | Use or disclosure | Moderate-High | Repurposing transaction data requires consent or exception |

| APP 7 | Direct marketing | Moderate | Carbon insights could be viewed as marketing sustainable products |

| APP 8 | Cross-border disclosure | High | Cogo is NZ-based; cross-border data transfer compliance unclear |

| APP 11 | Security | Moderate | Depends on Cogo's security practices and data handling |

Automatic Enrollment Analysis:

If CBA automatically enrolled customers without explicit opt-in:

- APP 3 Violation: Collection of personal information without proper solicitation

- APP 5 Violation: Failure to notify at or before time of collection

- APP 6 Violation: Using personal information for purpose other than primary purpose without consent

- Consent Requirements: Australian law requires "express consent" for sensitive personal information uses

Critical Unknown: What does CBA's Privacy Policy actually state about carbon tracking? This requires immediate review.

3.3 Westpac Implementation

Launch Date: May 2023

Status: Active

Compliance Profile: Similar to CBA; same vendor (Cogo), similar functionality

Key Difference: Launched post-CBA controversy, potentially with better documented consent mechanisms (requires verification)

3.4 Australian Digital Identity Context

Australia has implemented the most aggressive digital identity and age verification regime in the Western world:

Digital ID Act 2024:

- Commenced December 1, 2024

- Establishes national Digital ID system

- Accredited providers for identity verification

- Integration with government and business services

Age Verification Requirements:

- Under-16 social media ban (requires ID for all users to verify)

- Search engine age verification (commenced December 27, 2025)

- Biometric verification via AU10TIX (Israeli company)

Integration Risk for Financial Services:

- Banks are logical "accredited providers" under Digital ID Act

- Infrastructure already exists for identity verification

- Carbon tracking + Digital ID + transaction monitoring = comprehensive profile

- No legal barriers preventing integration

For detailed analysis: Australia's Digital Revolution: Age Verification and ID Checks Transform Internet Use

3.5 OAIC Enforcement Risk

Office of the Australian Information Commissioner (OAIC) Enforcement Trends:

- Increased penalties under Privacy Act amendments

- Growing focus on consent quality and transparency

- Heightened scrutiny of Big Four banks following Royal Commission

Potential Triggers for OAIC Investigation:

- Consumer complaints about lack of transparency

- Evidence of automatic enrollment without consent

- Inadequate notification of cross-border disclosure to Cogo

- Discovery of data sharing with Digital ID infrastructure

Additional Risk: Class action litigation (increasingly common in Australia for privacy breaches)

Risk Rating: High (particularly if automatic enrollment claims are substantiated)